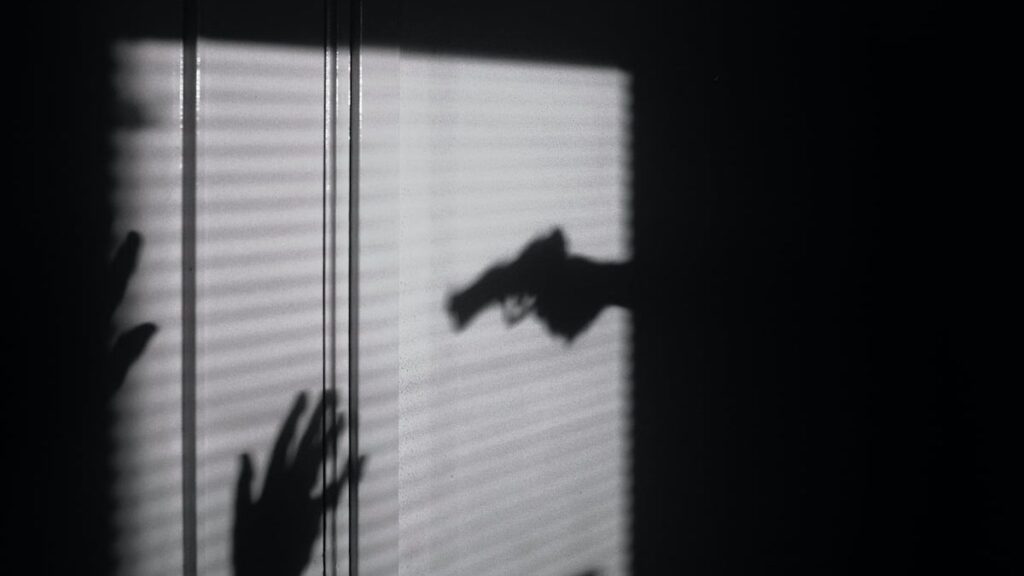

Who does not want to avoid the Enforcement Officer?

Published: 10 May 2022, 09:00Sergel Kredittjänster is the upstart in the credit industry that wants to challenge by creating a sustainable economy based on credit. Something that is done with well-founded credit decisions, an adapted and individualized payment and credit process and the goal that very few cases should go on to the Enforcement Officer. The industry’s mission has long been to collect as much as possible on the debts that debtors have to creditors. This has meant that a large number of cases are quickly passed on to the Enforcement Officer. This is what Torbjörn Sandahl, Head of Sales at Sergel, thinks is not sustainable. – We advocate being a little more restrictive when it comes to the Enforcement Officer and payment orders. An unpaid debt of 100,000s of kronor will probably be sent to the Enforcement Officer, but small consumer credits that someone failed to pay will not benefit from being sent to the Enforcement Officer, he continues. He sees several negative aspects with a credit system that sends debtors to the Enforcement Officer: people risk being knocked out of the credit system and in the worst case losing their homes and the companies that approved the credit lose their customer. Reduced customer churn is more profitable, and should be valued higher in the debt collection process. Several large companies are now taking the lead together with Sergel and driving the development.Larger debts that are difficult to payOver the past five years, both unsecured and consumer loans have increased. Several players allow private individuals to borrow hundreds of thousands of kronor without security and others focus on easily accessible credits through invoice purchases. According to a recent report from the Swedish Enforcement Agency, the number of debtors will decrease, but the total debts will increase avalanche. In ten years, the mountain of debt has grown by more than SEK 32 billion. The number of young people (18-30) applying for debt restructuring has doubled between 2019-2020. Debt settlement so early in life is devastating both for the individual and for society at large.Long experience in Banking & FinanceTo take advantage of the solid experience and industry knowledge that exists within Sergel, a dedicated management team has been created that works exclusively with Banking and finance-related receivables. – We can ensure a deep understanding of the products, customers, the industry and the solution alternatives that experience gives the best results, says Rickard Brolin, Business Area Manager. The company’s product department also continuously refines processes, scorecards and methods to ensure optimal recycling. Something that in combination with the company’s basic values of always safeguarding the debtor dialogue and solution-oriented handling creates the working method, We Care. With a focus on having a problem-solving effect for the customer and at the same time increasing the possibilities of recovering the loans lent. – We believe in being a debt collection and credit management company that is “the good guys” in the market. A company with a positive brand, which actively works to help individuals and companies in tough situations, says Torbjörn Sandahl. – Our strength is to be at hand. Despite all the digital aids we have, we receive close to a million calls annually from people who want help. It shows the importance of our personal approach and knowledge to solve the situation, says Rickard Brolin.About Sergel

Since the start in 1988, Sergel has focused on financial receivables, then as a sister company to Telia Finans, with credit and debt collection management. The customer portfolio now includes many well-known banking and finance companies in the Swedish and Nordic markets. A total of 165 employees, most of them in Customer Service. Read more at sergel.seThe article is produced by Brand Studio in collaboration with Sergel and not an article by Dagens industri